Manufacturing Overhead Cost

Content

Work in progress describes the costs of unfinished goods in manufacturing, while work in process refers to materials that are turned into goods in a short time period. The terms work in progress and work in process are used interchangeably to refer to products midway through the manufacturing or assembly process. The items that are currently Work in Progress do not include raw materials or finished goods. Work in Progress items, however, do not include raw materials or finished goods.

How is WIP valued?

WIP will again be valued as the percentage of the final fixed fee that has been earned by year end. This equates to the fixed fee multiplied by the year end degree of completion.

If raw material is combined with direct labor but is not ready to be sold, it counts as WIP inventory. For example, if a company sells bags of coffee, their WIP inventory would include bags, labels, coffee beans, and shipping boxes. Indirect labor is the cost to the company for employees who aren’t directly involved in the production of the product. For example, the salaries for security guards, janitors, machine repairmen, plant managers, supervisors, and quality inspectors are all indirect labor costs. Cost accountants derive the indirect labor cost through activity-based costing, which involves identifying and assigning costs to overhead activities and then assigning those costs to the product. In general, Work-In-Process inventory refers to partially completed goods that move from raw materials to a finished product within a short time frame. For example, consulting and manufacturing projects often have custom requirements based on the client.

How Do Companies Account For Work

WIP inventory eats up space in a storage space or factory floor that could otherwise be used for inventory that’s ready to sell, thus increasing carrying costs. Since WIP inventory takes up space and can’t be sold for a profit, it’s generally a best practice for product-based businesses to minimize the amount of WIP inventory they have on hand. Understanding WIP inventory can help you better understand supply chain management, so you can find ways to optimize your supply chain to drive more revenue. The cost of WIP inventory is a bit more complex than determining the value of finished goods, as there are a lot more moving parts. Before attempting to calculate your current WIP inventory value, here are some terms and calculations you will need to know first. Inventory systems used by organizations can be perpetual or periodic.

You can expect to see the cost of a manufacturer’s work-in-process inventory in the notes to its financial statements. Suppose you understand your WIP inventory and the impact it has on your business.

Here’s why this account warrants special attention and how auditors evaluate whether WIP estimates seem reasonable. Company A, a laboratory, has purchased 10,000 batches of saline solution. These batches are used in trials on patients during various Phase III clinical tests. They can also be used as supplies for other testing purposes, but have no other uses (i.e., Company A has no intention to sell the batches in the future). Management is considering whether the batches should be recorded as an asset.

Partially manufactured products; a Work in Process Inventory account is maintained for such products. An accounting report showing the cost to manufacture and the cost of goods manufactured. The cost of labor that cannot, or will not for practical reasons, be traced to the goods being produced or the services being provided. Total WIP Costs are calculated as a sum of WIP Inventory + Direct Labor Costs + Overhead costs. The restaurant may also have capital costs like monthly rent payments for its premises and maintenance on equipment used to make food. Inventory ManagementLearn the essentials of inventory management in this collection of guides.

Educational Material On Applying Ifrss To Climate

Another example of when a company might use job costing is if they create high-end, custom products. If a company is building custom furniture, they know the specific costs that went into each piece of furniture. All manufacturing costs except for those costs accounted for as direct materials and direct labor. Includes the direct materials, direct labor, and manufacturing overhead incurred during the period. Since manufacturing is a dynamic process of multiple constantly-moving parts, it is difficult to accurately calculate and account for WIP costs for each product.

- Inventory is referred to as Work-In-Process inventory in such cases.

- Therefore, Company A should account for the raw materials that can be used in the production of marketed drugs as inventory.

- While public companies must adhere to strict reporting guidelines, private companies typically have fewer reporting requirements, though they are still obliged to value items for tax reasons.

- Work-In-Progress is used in the construction industry to refer to a construction project’s costs instead of a product.

- For example, in a paper factory, the wood pulp used isn’t counted as an indirect material as it is primarily used to manufacture paper.

- For example, if a production process involves six steps, at the completion of step three the company might allocate 50% of their costs to the product.

The purpose is to generate information managers can use to make good decisions. The content of internal reports may extend beyond the double-entry accounting system. We hope this has been helpful in understanding the topic on Work In Progress. Labor costs for the restaurant are salaries for chefs and line and wait staff . Whereas, Work in progress is a term used mainly in the construction business when a certain building is being constructed. This means that Crown Industries has $10000 work in process inventory with them.

Improvements To Existing International Accounting Standards 2001

Companies must determine what commonly accepting inventory valuation method to use when accounting for inventory at various stages. The names signify the order in which inventory used or sold is accounted for. In the case of work-in-process, FIFO use means that materials used in production are valuated using the materials received first.

Secondary cost elements of cost element type 31 are results analysis cost elements. For a production order or a run schedule header, work in process is calculated in May, June, and July. The valuation for July should not change the work in process for May and June. The work in process calculated for later periods is overwritten by the current WIP calculation. The objective of IAS 2 is to prescribe the accounting treatment for inventories.

[IAS 2.39] This is consistent with IAS 1 Presentation of Financial Statements, which allows presentation of expenses by function or nature. Financial overhead consists of purely financial costs that cannot be avoided or canceled. They include the property taxes government may charge on your manufacturing unit, audit and legal fees, and insurance policies. These costs don’t frequently change, and they are allocated across the entire product inventory. The next step is to post the information shown on the timesheet to the appropriate job cost sheet, just as we did with direct materials. This is done for job 50 in Figure 2.5 “Direct Labor Costs for Custom Furniture Company’s Job 50”.

Ias 16

Work in progress includes goods that are partially completed, and are still in the production process. These are items that are mainly undergoing a certain process in the production cycle and are likely to be in-between places or different workstations. This cost is incurred for materials which are used in manufacturing but cannot be assigned to any single product. Indirect material costs are mostly related to consumables like machine lubricants, light bulbs , and janitorial supplies.

The system debits the unfinished goods account and credits the inventory change account . For goods that have been placed into finished goods inventory during the period, the system cancels the work-in-process inventory when you settle. This posting is performed in accordance with the posting rules defined in Customizing. The posting rules specify which accounts are posted during settlement. Companies assign manufacturing costs depending on the type of product they produce.

Work in Progress comprises of the full amount of raw materials that are required for a certain product because material listing and costing is carried out at the beginning of the production process. Consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated. It is often deemed the most illiquid of all current assets and, thus, it is excluded from the numerator in the quick ratio calculation.

Accordingly, the pre-launch inventory can be capitalized at the lower of cost or net realizable value. If the value of inventory is written down, the reduced amount is the new cost basis (i.e., if regulatory approval is ultimately obtained, the inventory is not written back up). A company will use process costing if it is producing a lot of a single product. To determine the cost of making one shirt, the company would take the total cost of fabric, the total cost of labor, and the total cost of overhead and divide it by the number of shirts they produced. They aren’t calculating the cost of each individual shirt as they go. Once a company has used the materials in the production of a good, those materials are moved on the balance sheet to the work-in-progress category. And once the company has finished the product and its ready to sell, it appears on the balance sheet as a finished good .

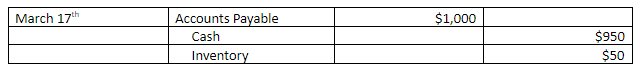

Work in process inventory refers to materials that are waiting to be assembled and sold. WIP inventory includes the cost of raw materials, labor, and overhead costs needed to manufacture a finished product. For accounting purposes, work in process is an asset, and therefore is aggregated into the inventory line item on the balance sheet. Work in process is usually the smallest of the 3 most common inventory accounts; the other two being raw materials and finished goods. The conceptual explanation for this is that raw materials, work-in-progress, and finished goods are turned into revenue. The cost of goods flows to the income statement via the Cost of Goods Sold account. This purchase of raw materials is further illustrated in the T-accounts shown in the following.

Work In Process Inventory Formula

For the majority of manufacturers, WIP inventory is the raw materials plus labor and production overhead. For more complex operations—like big constructions projects—it can include wages, subcontractor costs, and more. Again, that’s why most manufacturers minimize WIP before they tally it up at the end of the accounting period. The total cost of work-in-progress will also vary from one company to another, and from one industry to another. Some industries are more labor-intensive, while others have a lot of raw materials that go into their products.

- If we calculate the overall WIP inventory of the company is 10,000, plus $250,000 minus $240,000.

- It is added to the cost of the final product along with the direct material and direct labor costs.

- To calculate the total manufacturing overhead cost, we need to sum up all the indirect costs involved.

- Companies use this type of costing in industries where each good or service sold is its own separate unit.

- When it comes to inventory management, better insights mean better decisions.

- Inventory management helps in counting and maintaining all kinds of inventory.

- While finished good refers to the final stage of completion where all the required operations are done and waiting for the next subsequent stage, i.e., sale to a customer.

It is important to note that WIP is considered a current asset since it is inventory meant to be converted into cash within a year. All companies must therefore ensure they value their WIP correctly, especially for taxation purposes. Another reason to classify WIP inventory is because it’s a big factor in the valuation of your business.

Learn how to classify work in process inventory to increase the efficiency of your inventory management operations. Most ecommerce businesses rely on a supplier or manufacturer for sellable inventory. The process and flow of WIP inventory is important to understand because it can indicate how efficient your supplier or manufacturer is at producing finished goods. To help you better understand how to determine current WIP inventory in production, here are some examples. It passes through multiple work stations for a different operation to perform systematically after finishing and painting. As the cars move from one department to another, more costs are added to production.

What Is Inventory Accounting Example?

We use these three figures to calculate ABC’s raw material inventory. The WIP accounting on the restaurant’s balance sheet, therefore, will be a sum of entries for the costs of cooking ingredients , facility expenses, employee salaries and benefits, and insurance costs.

Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. A high WIP inventory number can indicate that your production process isn’t flowing smoothly and that there may be bottlenecks in the process. By tracking WIP, you can pinpoint and eliminate these problems before they hurt your bottom line. To clarify where WIP inventory falls in the production process, let’s look at it in the larger context of other inventory classifications. All of the following terms are under the umbrellas of manufacturing inventory.

How Do You Find The Beginning Wip Inventory?

In a periodic inventory system, inventory records are updated at specific periods. Learn about the definition and examples of a periodic inventory system, and explore the inventory management, advantages, and disadvantages of this system. In business, the supply chain refers to the processes involved in producing and distributing goods and services to consumers. Learn about the information technology used for supply chain management. Explore built-to-order , enterprise resource planning , radio frequency identification , barcodes, electronic data interchange , and e-business. Current assets are cash plus other assets that can be converted to cash or consumed within the next year. Explore the definition and examples of current assets, such as short-term investments and receivables, and learn how to calculate prepaid expenses.

County property values on the rise News chathamstartribune.com – Chatham Star-Tribune

County property values on the rise News chathamstartribune.com.

Posted: Wed, 01 Dec 2021 19:01:00 GMT [source]

In this lesson, we’ll compare traditional costing with activity-based costing in order to help students determine the advantages of one particular method of costing over another. Warehouse Management Systems enable companies to track their inventory with increased efficiency. Learn about warehouse management systems, the uses of a warehouse management system, simple systems, what is work in process inventory generally described as and more complex systems. Work-in-process is a much more significant issue when it involves the construction of a building. In this case, work-in-process includes the accumulated cost of the asset, which will continue to increase until the structure is declared complete. Supply chain and managing all types of inventory are established fields of expertise now.

- The LIFO method also lessens a company’s tax burden as the cost of items bought in the recent past is generally higher.

- To calculate the beginning WIP inventory, determine the ending WIPs inventory from the previous period, and carry it over as the beginning figure for the new financial period.

- Inventory is generally categorized as raw materials, work-in-progress, and finished goods.

- Before a company makes a profit on a product, it often spends a lot of time and money creating the product.

- In joint production, the work in process is shown separately for each co-product at the level of the order item.

- You might end up either scaling down your production or ultimately overproducing.

Figure 2.3 “Job Cost Sheet for Custom Furniture Company” shows a job cost sheet for Custom Furniture Company. Notice how the materials requisition in Figure 2.2 “Materials Requisition Form for Custom Furniture Company” is a line item in the job cost sheet for job 50. Understand how direct materials and direct labor costs are assigned to jobs. Company A outsources the manufacturing of certain products to Company B. Company A purchases and then sells the raw materials to Company B, which processes the raw materials into finished goods. Company A is then obligated to repurchase the finished goods from Company B. Company A would need to consider all available evidence to determine if there is an impairment. Company A would need to evaluate the reason for the recall, its history with past recalls, the likelihood that the quality issue could be fixed, and if the raw materials have an alternative use.

How to Effectively Manage a WooCommerce Site – Business 2 Community

How to Effectively Manage a WooCommerce Site.

Posted: Wed, 01 Dec 2021 13:41:46 GMT [source]

Is a term that describes products that are partially finished and at various stages of the production chain. Taking the time to better understand WIP inventory can give you a deeper understanding of your supply chain management, which means better optimization and more revenue. Besides these costs, ABC also incurs manufacturing overheads in the form of worker benefits, insurance costs, and equipment depreciation costs.

Author: David Paschall